A methodology for valuation of DER

Lance Hoch | 8th July 2020Modelling the net market benefits of network expenditure to increase DER hosting capacity

Distributed energy resources (DER) – rooftop PV and battery storage (including electric vehicles which make storage moveable) – can provide material economic benefits to the electricity supply chain. However, accommodating increased levels of DER may require capital expenditure to augment the distribution system. Those costs, and the economic benefits they enable, will differ based on a number of factors including the current and forecast levels of DER in the local area, the technical characteristics of the local area network, and the supply-demand characteristics forecast to affect the wholesale electricity market now and into the future.

Oakley Greenwood has developed a methodology for addressing these issues and codified it within a generalised model that can be adapted for use with any DER technology, and different types of hosting capacity enhancement projects applied to all feeder types. The model itself has been developed over the course of a number of project assignments and has recently been applied in full form to assess the net economic benefits resulting from three different levels of DER hosting capacity, across four different feeder types.

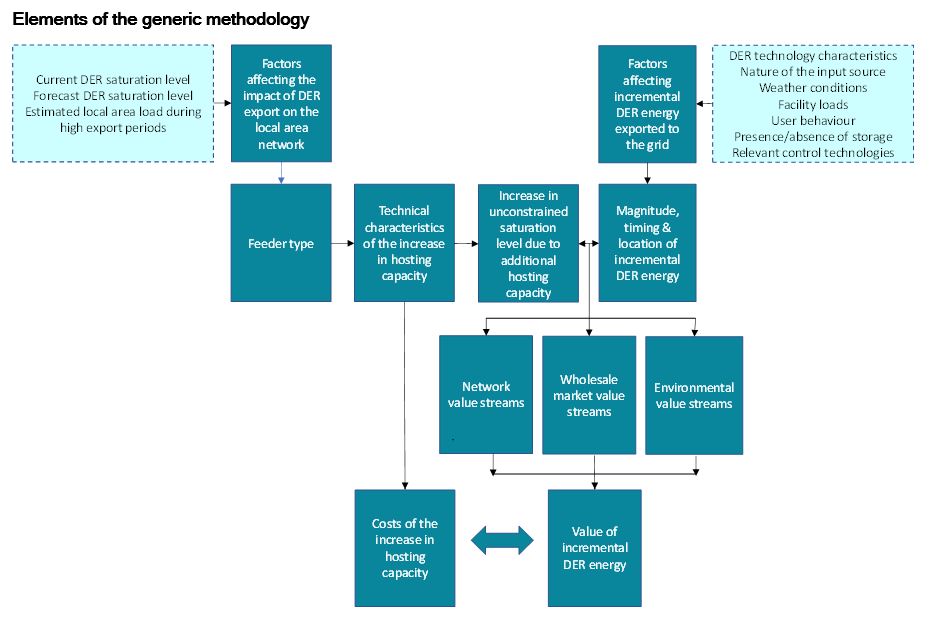

The figure below provides a schematic of the methodology, and also notes where the specific inputs to it will vary based on the nature of the DER type(s) being considered and the types of feeders whose hosting capacity is to be enhanced.

Source: OGW

At a general level, quantification of the net economic benefit accruing to a marginal increase in DER hosting capacity must reflect, as a minimum:

- The costs of facilitating the increase in hosting capacity (e.g., capital expenditure on network augmentations; opex/capex for network orchestration projects); and

- The economic benefit [1] stemming from the increased energy that is enabled as a result of that expenditure, which can be further disaggregated into:

- Network benefits; and

- Wholesale market benefits.

The primary benefits that could potentially accrue to the network from the deployment of incremental hosting capacity are:

- Improved voltage control (i.e., a reduced number of over-voltage excursions),

- Network augmentation deferral, and/or

- Downsizing of asset replacements.

An increase in DER export enabled by an increase in network hosting capacity could also provide economic benefits in upstream portions of the supply chain including:

- A reduction in the cost of producing electricity (i.e., a productive efficiency benefit); and

- A reduction in the overall price charged to end customers for electricity (i.e., an allocative efficiency benefit).

Quantifying the benefits that can be expected to accrue to both the network and wholesale portions of the supply chain requires the ability to accurately forecast:

- How much additional energy will be facilitated as a result of any network expenditure to increase DER hosting capacity, and when that additional energy will be facilitated (e.g., time/s of day, season/s); and

- How many additional DER facilities might be incentivised as a result of providing that additional hosting capacity (e.g., whether the ability to export this additional amount of energy improves the economics of investing in DER such that it incentivises additional take-up of DER relative to a ‘do nothing’ case, and whether and to what extent this leads to lower (or higher) costs in the various parts of the supply chain).

The amount of additional energy that will be facilitated as a result of a network business’ investment in DER hosting capacity will depend on a range of issues, not the least being the consideration of how much energy would have been curtailed had the investment not occurred (i.e., the ‘do nothing’ case).

This will differ depending on the type of DER that is being considered. However, at a generic level, this involves:

- Using technical and historical revealed data to estimate the level of DER saturation that leads to no (or minimal) energy being curtailed. This should reflect various factors, including location and feeder type; then

- Establishing:

- The unitised costs (e.g., capex per feeder) for the different technical solutions being considered, and

- The improvement that these technical solutions are expected to make to the saturation level of DER that could be accommodated without constraint.

- Determining current and forecast DER uptake at an LGA level for each year of the evaluation period, and then allocating those forecasts to each of the feeder types that are estimated to service those LGAs, based on drivers specific to the different types of DER and the relevant characteristics of the local area.

- Estimating the current and forecast number of customers served by different feeder types in each LGA, for each year of the evaluation period, which when combined with the previous step, allows a forecast DER saturation level to be established.

- Quantifying the additional DER export that is facilitated in each year as a result of the investment in additional DER hosting capacity, having regard to the relevant factors for each type of DER that would lead to non-zero levels of energy needing to be constrained under the ‘do nothing’ case. For example, in the case of rooftop PV:

- The relationship between certain types of weather events occurring and DER having to be constrained (e.g., due to over-voltage issues on the network on mild, sunny days when high levels of PV export tend to occur),

- The probability of those types of events occurring (based on analysing historical data),

- Historical DER production on those days (e.g., the average capacity factor of a PV system on those days), and

- Each feeder’s forecast saturation level.

- Forecasting the economic value that is expected to accrue to the wholesale and network parts of the electricity supply chain over the life of the network investment, in light of their expected supply/demand characteristics, as a result of the additional energy that would be exported under each of the investment solutions being contemplated, and

- Comparing this value (in NPV terms) to the costs of the hosting capacity required to facilitate that additional energy export.

The model can also address several other issues that are often of interest regarding the benefits of DER including:

- Its impact on carbon emissions (and particulate emissions where suitable generation system data is available) [2], and

- Its distributional (i.e., equity) impacts, taking into account the change in the wholesale price that is expected to result from the additional energy exported and the approach (e.g., tariff changes) network businesses are proposing (or would be expected) to adopt to recover the forecast capital expenditure required to provide the increase in hosting capacity.

[1] There may also be environmental benefits (e.g., a reduction in greenhouse gas emissions) and health benefits (e.g., a reduction in particulate emissions) from incremental DER exports, depending on the nature of the electricity generation it supplants. These emission reductions can be readily quantified in physical terms, but their value in monetised terms has not been universally agreed.

[2] We use QUAFU, our in-house proprietary market simulation model, to provide half-hourly data on these impacts, but coarser, more generalised emission rates can be used if market simulation data is not available.